Stock specific angle for Dmart's success First of all, I would congratulate you all for taking first step by coming to this blog to check my analysis of Avenues Supermart, i.e Dmart. For somewhat experienced people; you can directly go to the bottom of the page to read the finer points responsible for Dmart's success; and for newbies you can go through the introduction. What is Dmart? Dmart is the brand name of supermarket chain Avenue Supermart: founded by Radhakishan Damani Ji. Dmart with ts 140 branches has its presence in Maharashtra, Gujarat, AP, Telangana, Karnataka, MP, Chhattisgarh, Rajasthan, NCR, Tamil Nadu, Daman-Diu & Punjab. It is one of the largest & most profitable supermarket chain in India. Now coming straight to stock specific angle - The floor price for Dmart IPO was Rs. 295-299, and it it got listed on 21st March 2017 with massive gain of Rs. 349.5 (awesome 117% - just in 11 days); and as of dt 8/12/2017 stock is trading at 1130.

Posts

Showing posts from 2017

- Get link

- Other Apps

Formal vs Informal Credit Mechanism - Thought to ponder on. Today while talking to an uber driver - I came to know that almost all drivers resort in some credit activities to roll over the money - and he also said credit card is not easily available to us; so we go for approx. 4.5% to 5% credit through un-organised mediums offering credit. At other interaction in past - I came to know that Subjiwala's take credit of 5k to 6k (again from un-organised medium offering credit); and at EOD pays Rs. 100 in lieu for that credit - do you know the percentage.....It's HUUUGEEEEE. Now, this kept me thinking - how much credit the formal economy offers to its own citizens? Why not a mechanism where we tap these market of drivers, subjiwala's, pani puri wala's, etc.

- Get link

- Other Apps

What should I know before investing in an IPO in the Indian market, being a trader who is looking for a short term entry for immediate profits? Being a trader - who want to deal in IPO’s in Indian Market; most important things you should be aware of: Lot Size of IPO Issue Price - how that price stands in comparison to its face value? Is it pricey? Company Fundamentals Why Company is going for IPO or in other words - what company says regarding where the IPO proceeds would be utilized? Ongoing GMP - Grey Market Premium? Kostak? - How’s the response apropos to the IPO. Note: I have just mentioned the important details you should check before applying the IPO. For more information - You can check Stock market tips and IPO Analysis | Chanakya Ni Pothi R-A-N-D-O-M Thoughts....!! Chittorgarh City Info Finally, please go through the below video for more clarity on application & allotment process of IPO: Hope, I was able to guide you on what you were looking?

- Get link

- Other Apps

Dtd 08-5-2017 at 1:00 PM GMP of S Chand - Rs. 31 - Rs. 36 i.e. 22*31 - 22*36 on listing day itself. Kostak: Rs. 450 Gr8 fall in GMP; go for it if extra money ... Check for more details: https://www.quora.com/How-worth-are-the-IPOs-of-S-Chand-and-Company GMP of HUDCO - Rs. 28.25 - Rs. 29.75 i.e. 250*28.25 - 250*29.75 on listing day itself. Kostak: Rs. 900-950

- Get link

- Other Apps

Should I buy Hudco’s IPO? Yes, you should definately buy IPO of Hudco (Housing & Urban Development Corporation). Market participants are mistaking HUDCO as a housing finance company and comparing it with the likes of PNB Housing Finance etc. The fact is totally opposite as 89.88% of the loan book of HUDCO is to State governments and its agencies and 10.17% to private sector. HUDCO’s total loan portfolio is 31.28% (30.34% to state govt for social housing loans, 0.40% to individuals and 0.57% to private sector companies) and 68.72% of the total loan portfolio is advanced for Urban Infrastructure like water supply projects, Roads and Transport, Power, Sewage and Drainage etc. If we calculate PE of HUDCO- after IPO (on basis of Dmart/Shankara & Music Broadcast & its safest GMP of 27) then it will be trailing at PE of 12, which is quite cheap. I would say go for the IPO of Hudco -> apply minimum lot of 300 at upper price of Rs. 50 (there may be retail discount to)

- Get link

- Other Apps

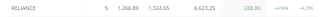

Can I buy Reliance Industry stock now, as of dtd 31/3/2017? If you are planning to buy Reliance Industries share; go ahead and buy them in a staggered approach + buy them on every dips. Why?? Above pic, is of my portfolio where I was buying daily one stock of Reliance Industries from March 23rd (portfolio is very small - but I believe in buying with a staggered approach and in that too I buy multiple companies. Reliance Industries is very fundamentally strong company with profitable books ( I don’t think you need someone to tell you this fact ). On top of this, before couple of months they came into market with JIO -> cornered a large pie of market share with free data and calls -> and now in Mid February Mr. Mukesh Ambani announced that they will monetize Reliance JIO with Reliance Prime fee of Rs 99, and then Monthly fee of Rs. 149/303/450 and so on…which will in turn make their books profitable aftre couple of months. It’s a dirty business world… Second

- Get link

- Other Apps

Will the stock market ever go up again? In 1992, the market was trading at its highest PE of 21.88 -> fast forward 2017 -> market is trading at PE of 17.04 compared to markets highest PE of 21.88. Above is just one example of the fact that 'Markets will go even higher from today's point'; that is another thing that 'Markets will stop/pause/work sideways to take a ‘ Breather '. Other important facts: Fundamentals of Economy are and will become strong with Time. Stable Government at centre. Majority in Loksabha (just check the 'GOD Speed' at which GST bills are getting passed. 2019 and there would be a majority in Rajya Sabha, along with Lok Sabha (where there is still a majority). ‘ Macro Demand Economics ' is on a ‘ hockey stick ' growth. ‘ Per capita income ' is increasing day by day. Above are only some points, which I remember as of now; and believe mw there are many pointers which point to fact - ' Markets will